Bond yield to maturity formula

Maturity Time to Maturity ie. Yield to Maturity YTM Formula.

Bond Yield Calculator

The bonds face value is 1000 and.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

. A bond yield is the amount of return an investor realizes on a bond. The formula for determining approximate YTM would look like below. Current trading price Δyield.

Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. It doesnt allow us to isolate a variable and solve. Current Price of Bond Present Value pv.

Formula YIELDsettlement maturity. Youre wondering whether you would invest in the bond. Importance of Yield to Maturity.

YTM is therefore a good measurement. P is the price of a bond C is the periodic coupon payment r is the yield to maturity YTM of a bond B is the par value or face value of a bond Y is the number of years to maturity. Yield to maturity The biggest difference between IRR and.

Yield to maturity can be mathematically derived and calculated from the formula. How it is Done. Where the coupon payment refers to the total interest per year on a bond.

The bond yield formula evaluates the returns from investment in a given bond. The n is the number of years it takes from the current moment to when the bond matures. On this bond yearly coupons are 150.

Bond Yield to Maturity Formula. Bond price when yield decreases by 1 Price. The YTM is the annual rate of return that the bond investor will get if they hold the bond from now to when it matures.

Formula to Calculate Bond Equivalent Yield BEY The formula is used in order to calculate the bond equivalent yield by ascertaining the difference between the bonds nominal or face value and its purchase price and these results must be divided by its price and these results must be further multiplied by 365 and then divided by the remaining days left until the maturity date. Five years until maturity. The formula for calculating the yield to maturity YTM is as follows.

It is the rate of return that a bondholder earns if he holds the bond till maturity and receive all the cash. Learn the variations of yield to maturity. The YTM formula needs 5 inputs.

Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page. To make this decision you want to know the Yield to Maturity also called Internal Rate of Return from investing in the bond. These actions decrease the yield on a bond.

As this metric is one of the most significant factors that can impact the bond price it is essential for an investor to fully understand the YTM definition. Yield is different from the rate of return as the return is the gain already earned while yield is the prospective return. Bond price when yield increases by 1 Price-1.

The discount rate which makes the present value PV of all the bonds future cash flows equal to its current market price. The approximated YTM on the bond is 1853. Or they may put it which means that the issuer repurchases the bond before its maturity date.

The function is generally used to calculate bond yield. Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures. Bond yield is the internal rate of return of the bond cash flows.

Yield to maturity. Yield to maturity YTM is similar to current yield but YTM accounts for the present value of a bonds future coupon payments. Yield to Maturity YTM acts as an indicator of potential returns from a Debt Fund hence understanding how it gets calculated is the key to getting a grip on how it will.

YTM is beneficial to the bond buyer because a rising yield would decrease the bond price hence the same amount of interest is paid but for less money. The coupon rate for the bond is 15 and the bond will reach maturity in 7 years. Bond issuers may not choose to allow a bond to grow until maturity.

It is calculated as the percentage of the annual coupon payment to the bond price. Determine the yield to maturity YTM. Determine the years to maturity.

Suppose a bond is selling for 980 and has an annual coupon rate of 6. Thats right - the actual formula for internal rate of return requires us to converge onto a solution. Said differently the yield to maturity YTM on a bond is its internal rate of return IRR ie.

Several types of bond yields exist including nominal yield which is the interest paid divided by the face value of. The yield to maturity YTM book yield or redemption yield of a bond or other fixed-interest security such as gilts is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price holds it to maturity and receives all interest payments and the capital redemption on schedule. It is the theoretical internal rate of return.

The same as coupon rate or coupon yield the rate of interest youll earn annually from a bond. Check out the image below. Calculation of the coupon payment annual payment.

Number of years till Maturity of the Bond. The n for Bond A is 10 years. Coupon rate The bonds annual interest earnings.

They may call a bond which means redeeming it before it matures. The exact formula is. For this particular problem interestingly we start with an estimate before building the actual answer.

In this example YTM 8. Common examples of yield spreads are g-spread i-spread zero-volatility spread and option-adjusted spread. What is the Yield to.

Price Current Market Price of the Bond. It matures in five years and the face value is 1000. In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity.

As a financial analyst we often calculate the yield on a bond to determine the income that would be generated in a year. Price and the face value of the bond using the following formula. The yield to maturity calculator YTM calculator is a handy tool for finding the rate of return that an investor can expect on a bond.

Percentage point change in yield note that its squared. Yield spread is the difference between the yield to maturity on different debt instruments. You can use Excels RATE function to calculate the Yield to Maturity YTM.

It completely ignores the time value of money frequency of payment and amount value at the time of maturity. How to Calculate Yield to Maturity. Yield to Maturity Calculation of a Bond.

Yield To Maturity Ytm Approximation Formula Finance Train

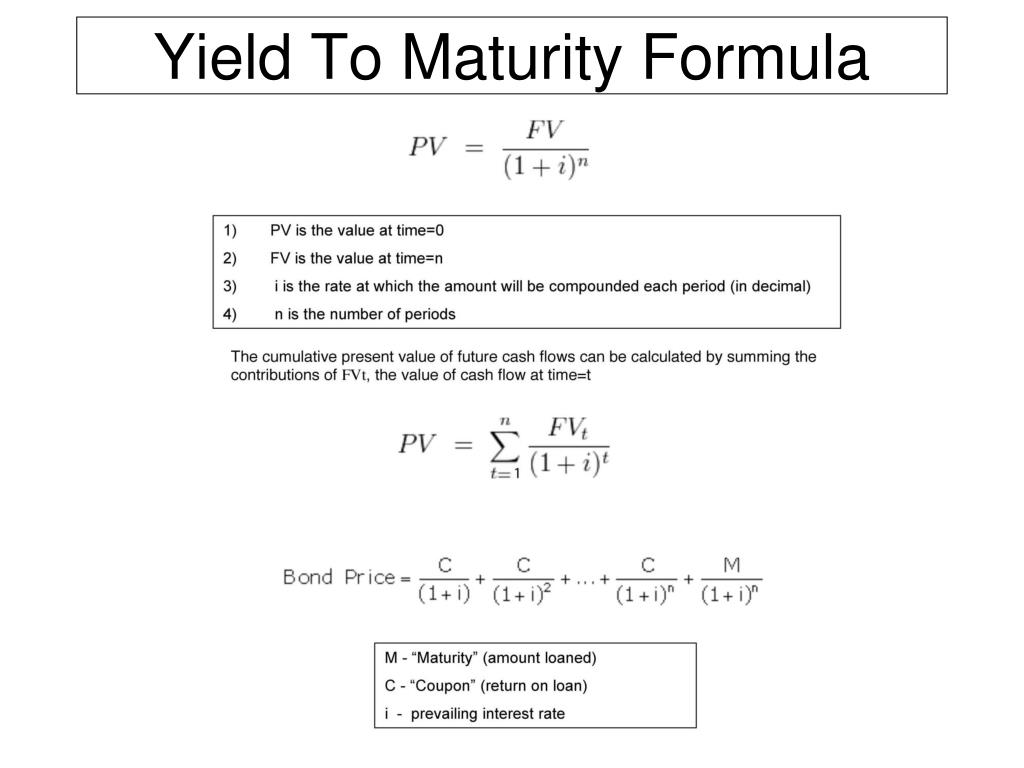

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id 5774476

Yield To Maturity Ytm Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Fixed Income

Calculate The Ytm Of A Coupon Bond Youtube

Bond Yield Calculator

Yield To Maturity Formula Examples How To Calculate Ytm Video Lesson Transcript Study Com

Yield To Maturity Indiafreenotes

Yield To Maturity Ytm Formula And Calculator Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Ytm Formula And Calculator Excel Template

Yield To Maturity Approximate Formula With Calculator

Yield To Maturity Ytm Meaning Formula Calculation

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Zero Coupon Bond Formula And Calculator Excel Template

Yield To Maturity Ytm Approximation Formula Finance Train